Create a CPI Side Note

Watch this video to learn about CPI Recurring Payments!

A side note is in addition to the current vehicle loan, and you can create it from the customer's account. It is generally added for repairs that the customer needs to pay out in installments. A side note can also be created for a reason such as Collateral Protection Insurance (CPI), which is also added to an account separately from a regular payment. Creating a recurring balance enables dealers to recognize an insurance receivable as it comes due instead of a lump sum balance for insurance due over the life of the loan.

- From the Account page, click the Transactions icon

and choose Create a Side Note.

and choose Create a Side Note.

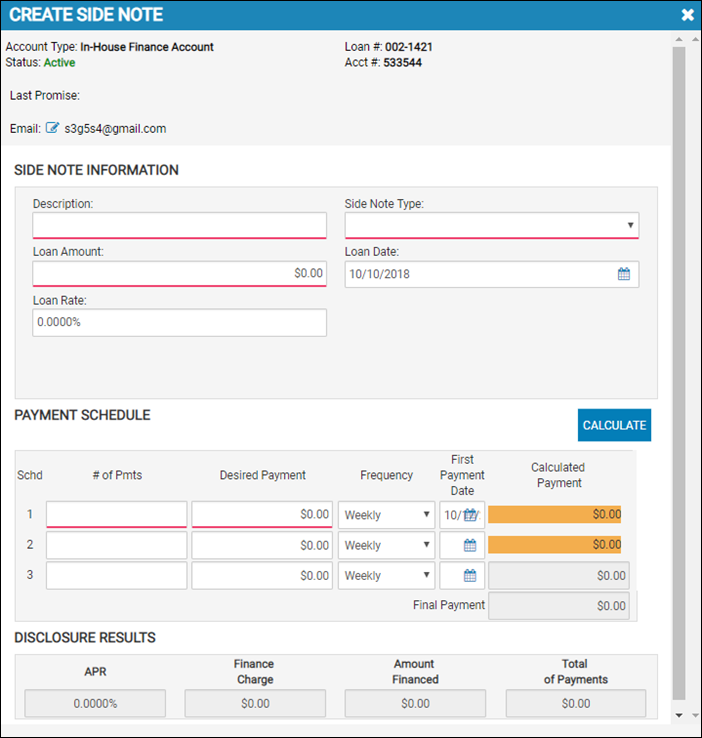

The Create Side Note pop-up window opens.

- Type a Description.

- Choose the Side Note Type, which can be a side note sub-type.

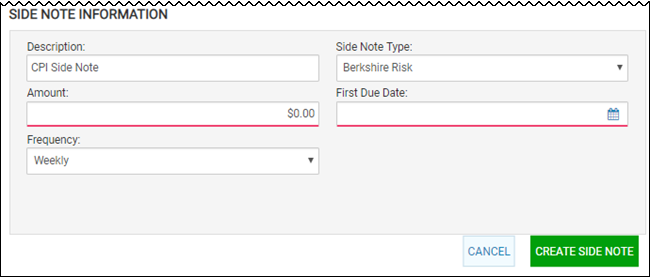

To create a recurring CPI side note

If you choose a recurring CPI option in the Side Note Type field, the Amount field replaces the Loan Amount field and the First Due Date field replaces the Loan Date field. The fields change to accommodate the CPI selection and you do not complete a payment schedule or Loan Rate.

- Type the recurring insurance Amount.

- Choose the First Due Date and Frequency.

- Click Create Side Note.

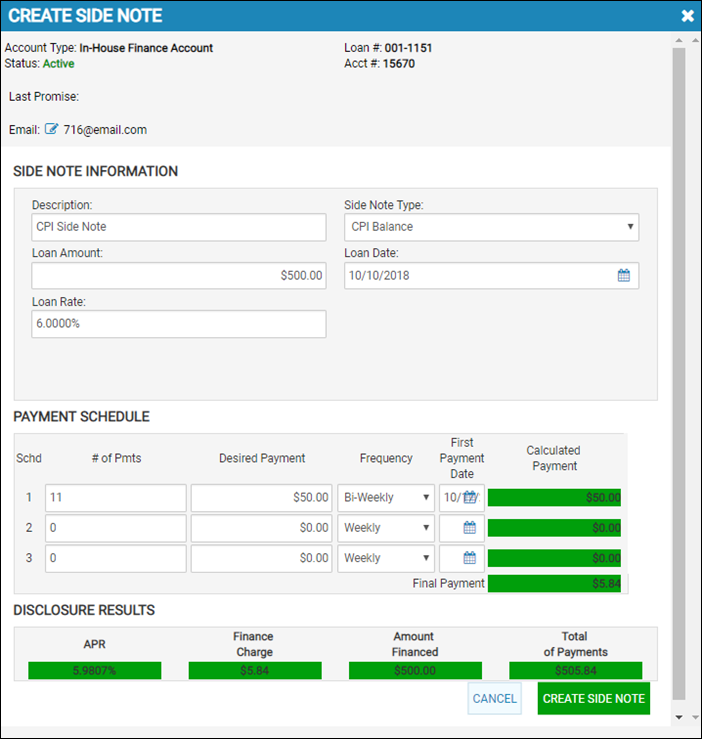

To create a non-recurring CPI side note

If you choose a non-recurring CPI side note option in the Side Note Type field, complete loan information and a payment schedule

- Click Calculate to see calculated payments as shown above.

- Click Create Side Note.

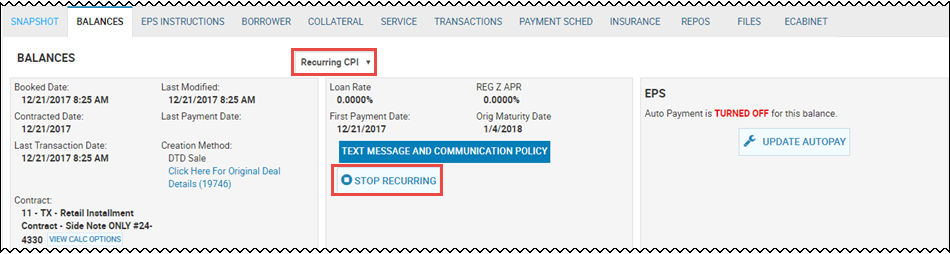

To stop a recurring CPI side note

You can stop a recurring CPI side note and start it again as needed.

- From the Account page, click the Balances tab.

- Choose Recurring CPI, and then click Stop Recurring to pause the recurring side note.

To restart a recurring CPI side note

You can start generating the balances at the next possible future date. The system will not create any past dated ones.