Reporting Bankruptcy

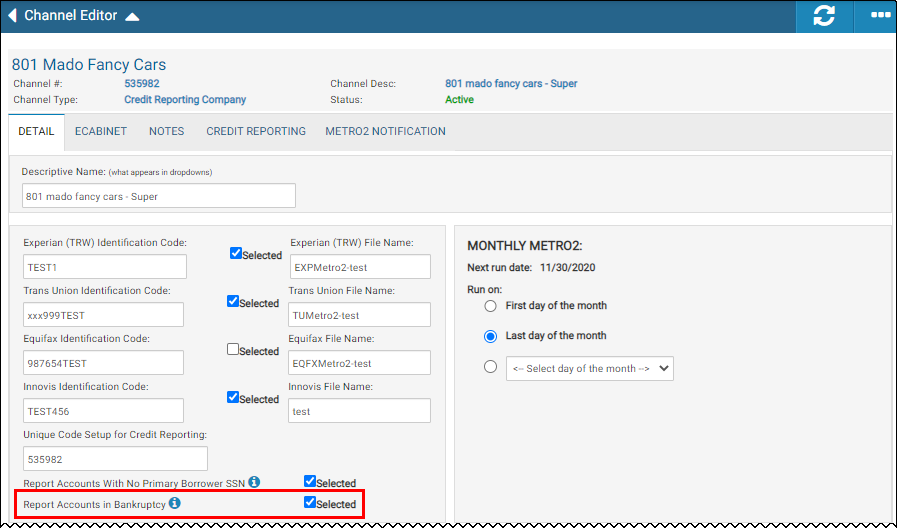

The accounts marked as bankrupt will not be reported on the Metro 2 files unless the check box to report bankrupt accounts on Metro 2 has been checked on the Detail tab of the Credit Reporting Company channel. This feature is only available with enhanced credit reporting.

Credit Reporting Account

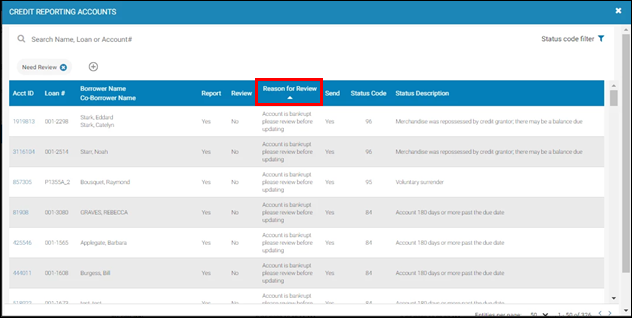

When Report Accounts in Bankruptcy is checked, the accounts marked as bankrupt will start appearing in Credit Reporting Accounts when the Needs Review filter is selected. The Reason for Review column will indicate Account is bankrupt, please review before updating.

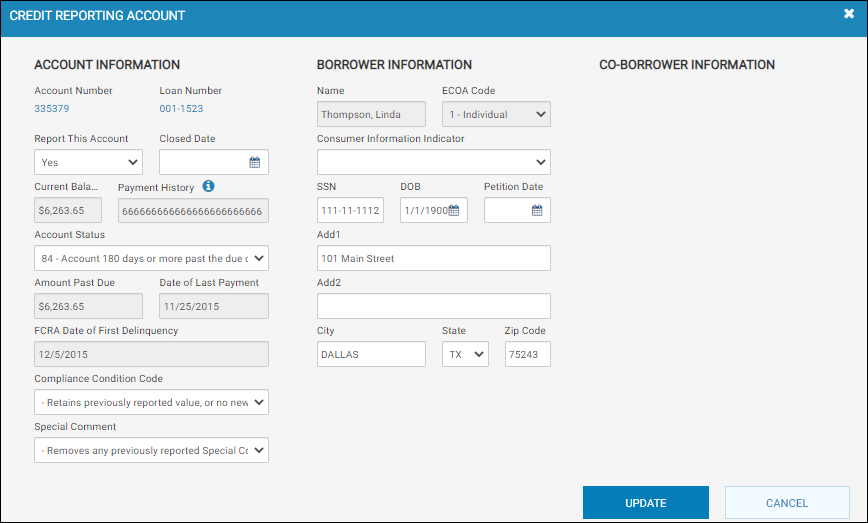

Click an Acct ID to open the Credit Reporting Account modal and confirm by clicking on the Update button to ensure the bankrupt account is reported on the Metro 2 and moves to the Reporting status. If the user does not explicitly update, then the Accounts that are bankrupt will be reported on the Metro 2 once the credit run has been approved. Bankrupt accounts that are in the Needs Review status are still reported.

The security right Can Edit Metro2 Account Information under General Tools for User Detail must be enabled following the Assign User Security Rights instructions for admins to edit these fields.

Depending upon the specific circumstances surrounding each Bankrupt account that you flag to be included in your Metro 2 file, our system may not insert the appropriate (CRRG-compliant) value in the following fields. You are ultimately responsible to ensure the values are correct for each bankrupt account.

Credit Reporting Account Fields

When the Metro 2 file is created, all accounts that are bankrupt and reported will have fields showing a certain set of values. Those fields are denoted as (Metro 2 field) in the following list in addition to the fields listed for the Credit Reporting Account modal.

| Field | Description |

| Consumer Information Indicator | The Consumer Information Indicator (CII) will reflect the value captured when the account was added to bankruptcy. Any changes to the CII indicator from the modal window will be reflected in Accounts and will be used for current as well as subsequent Metro 2 reporting. |

| ECOA Code | The dealership admin users can change the value of the field per the CRRG guidelines for bankruptcy. |

| Payment History |

The Payment History is calculated on the basis of the petition date captured at the time of marking the account as bankrupt. Month Bankruptcy Filed

Months Between Petition Date and Bankruptcy Resolution

Once the bankruptcy has been removed on the account, (i.e., the bankruptcy flag has been removed on both the borrowers if there is more than one borrower on the account or on the primary borrower if there is only one borrower), then the payment history will be reported as normal. |

| Current Balance | Outstanding balance amount. |

| Amount Past Due |

Amount past due at time of petition. Any changes to the amount past due on the Credit Reporting Account modal will not be written back to the account. |

| Date of First Delinquency |

Date of First Delinquency (DOFD) that led to the status being reported, or Date of the bankruptcy or Personal Receivership Petition or Notification. |

| Account Status | Status at time of time of petition. |

| Scheduled Monthly Payment Amount (Metro 2 field) | Contractual monthly payment amount. |

| Date of Account Information (Metro 2 field) | Current months date. |

| Payment Rating (Metro 2 field) | Payment rating will correspond to the Metro 2 Account status based on the number of days past due at the time of petition. |