Post a Non Earn Principal Adjustment

A non-earning principal adjustment refers to a sales tax deferred contract where you need to make an adjustment to the sales tax balance because it is considered non-earning principal. See Understanding Non-Earning Principal (TX Only).

- From the Account page, click the Transactions icon

and choose Post Non Earn Prin Adjustment.

and choose Post Non Earn Prin Adjustment.

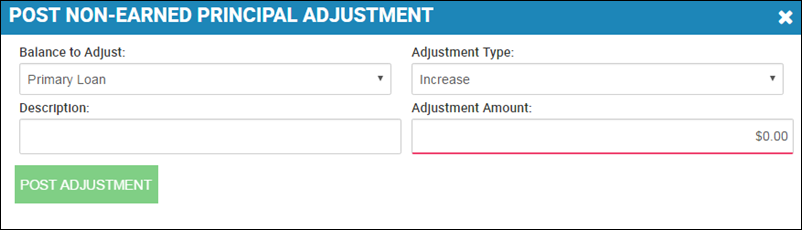

The Post Non-Earned Principal Adjustment pop-up window opens.

- Choose the Balance to Adjust, such as the primary loan.

- Choose whether you want to increase or decrease the principal.

- Type a Description and the Adjustment Amount.

- Click Post Adjustment.

You receive a confirmation message and return to the Account page.